Signed in as:

filler@godaddy.com

Signed in as:

filler@godaddy.com

Engaged to broaden the investment community following while the drill program advanced, efforts culminated in a takeover offer.

Converted key sector voices and investors to endorse the company.

Introduction of value merits of the assets and effective communication created an upswing in the market value.

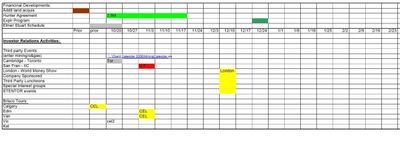

Corporate Value, Capital Markets activities and Investor Engagement should not be a random event. An annual plan and IR 'Program' should tie together corporate developments with marketing and capital.

The initial step in the ACP 'Program' is a full review of the next 12 and 18 month corporate milestones and deliverables. This is then synced with target valuations for each advancement. Finally the investor marketing and communications strategies are scheduled to coincide for maximum results.

ACP through its experience has found that exposure to a company investment opportunity in 3 different occasions resonates with investors and creates legitimacy. This can be a personal presentation, trade show, and BNN. Or perhaps a trade magazine, newsletter, and an associate comment.

The ACP Program is designed to achieve optimal reach through the exercise of a multitude of tools deployed at the appropriate timing in the company's 12 to 18 month development calendar.

Whatever the company's long term strategy, if it is executing on its plan there will be an acquisition proposal offered at a premium by a third party for strategic or next phase of growth purposes. This premium should exceed the program mapped value.

Each company is unique and has different needs and plans. Each Program is built from the ground up with this in mind to maximize results for each client.

In a dynamic market change is inevitable and flexibility in adapting is required. The Program is reviewed quarterly with Management to ensure timely effectiveness.

This website uses cookies. By continuing to use this site, you accept our use of cookies.